Pro traveler tip: Find your bank’s ATMs at the airport as soon as you land. During your travels, be on the lookout for ATMs with your bank’s logo. Before travel, check to see if your bank has an ATM network - or even bank affiliates - at your destination so you have a better chance of avoiding unnecessary fees. The best way to exchange currency abroad while avoiding fees is through your bank’s ATM network. So where should you get your foreign dollars while abroad? An ATM (preferably in your network) Just in case your bulk cash stash still isn’t enough, you may need an exchange option for when you arrive at your destination.

#Currency compare rates download#

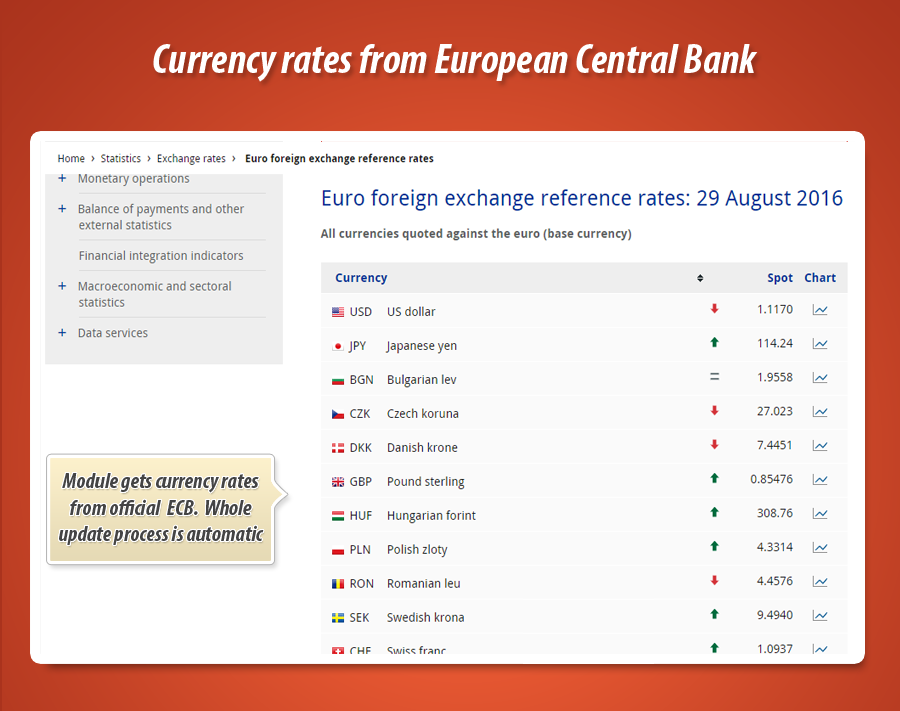

Pro traveler tip: Download an international banking app or use an online currency converter, such as Oanda or XE.com, so you can keep tabs on the changing exchange rates by the day. And even though online exchange rates can be a bit higher than your bank’s (and bring delivery charges), this is still a more favorable option than some we list in sections below.ĭo some research to find the right online currency exchange website with:Ī wide array of countries and currencies for exchangeĪny other additional services and support Keep in mind, though, that when it comes to ordering cash online, some currencies may not be available to exchange and some countries may have monetary policies and convertibility restrictions. Order through the exchange site and the cash will be delivered directly to you. Currency exchange websitesĬurrency exchange websites, such as Currency Exchange International (CXI) and US First Exchange, are centralized online platforms that tend to offer competitive exchange rates, serving as a convenient option for securely purchasing foreign currency. Pro traveler tip: It’s always a good idea to let your bank know you’re traveling for fraud protection purposes. Be sure to shop around and request your new currency with plenty of time to spare before your trip. For some banks, orders completed before a certain time can be eligible for next-day delivery. Among five banks that ValuePenguin reviewed, the typical time to receive your money at home or at the branch was one to seven business days. The fees associated with currency exchange - and turnaround for receiving your new currency - can vary among institutions. Currency can be shipped to your home address, office or nearest branch (sometimes for a fee, depending on the size of the order). In some cases, a bank will exchange currency fee-free, while others may charge you a fee if you order less than a certain amount of cash (often less than $1,000). Generally, banks will offer their checking or savings account customers currency exchange online, by phone or in person at cheaper rates than other sources.Ĭonveniently, some banks, like Wells Fargo and Bank of America, provide online orders that are deducted from your checking or savings account. are: Banks and credit unionsīefore you leave on your international trip, check with your bank or credit union for their currency exchange services and rates. The best, most cost-effective places to exchange and convert currency in the U.S.

0 kommentar(er)

0 kommentar(er)